Large-hub Airports Ratemaking - 2022 Update

(Draft August 29, 2022 by Dafang Wu; PDF Version)

This document summarizes the ratemaking methodologies for U.S. large-hub airports, using the calendar year 2019 classification established by the Federal Aviation Administration.

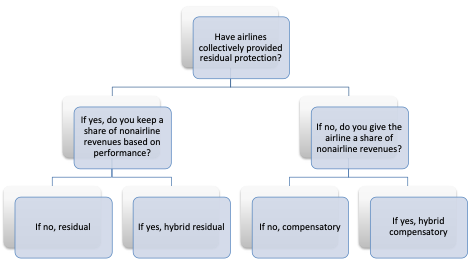

I was planning to write an article about why a hybrid ratemaking methodology should be further defined to be a hybrid residual or a hybrid compensatory, but I realized I wrote the article in 2015: Classifying Airline Rates and Charges Methodologies. As illustrated below, it is critical to know whether an airport has a residual safety net, which makes an airport a residual airport.

I also summarized the large- and medium-hub ratemaking methodologies in the 2017 Airport Finance 101, so this document is an update for the large-hub airports, sorted alphabetically.

For comments and discussions, please email

ATL

Rate document:

- Name: Airport Use and Lease Agreement. Isn’t it fun that we have so many different names for U.S. airports?

- Expiration date: June 30, 2036. There are two versions of the agreement with a 5-year and a 20-year term, according to the 2021ABC OS page D-1. The 5-year agreement can be extended every five years through 2036.

- Link: although the website does not have a public copy, we can find a 5-year version attached as part of the 2016 competition plan. As a side note, if we cannot find a copy of the rate document on the airport website, the next possible sources are the competition plan and the board meeting materials. Otherwise we have to rely on the summary included in the official statement.

- Investor relationship site: not found

Ratemaking:

- Residual protection: none

- Revenue sharing: see section 8.08 for a complicated revenue sharing mechanism that is based on terminal concession revenues and passenger traffic, subject to certain limitations.

- Airport-wide methodology: hybrid compensatory

- Airfield methodology: cost center residual

- Details: total requirements plus hard coverage minus non-signatory landing fee, divided by signatory landed weight, see section 8.02. The cost recovery includes amortization of cash-funded assets.

- Terminal methodology: cost center residual

- Details: total requirement plus hard coverage divided by weighted terminal space, see section 8.03, especially 8.03(B)(4)

- True-up/settlement: variance settled in the following year through cash/credit, see section 8.10.

- Other comments:

- Traffic statistics: https://www.atl.com/business-information/statistics/

- Domestic terminal common use charges are provided in a separate document

- International terminal common use charges are provided in section 8.05

BOS

Rate document:

- Name: none, rate by resolution

- Expiration date: none

- Link: none

- Investor relationship site: https://www.massport.com/massport/finance/investor-relations/#

Ratemaking:

- Residual protection: none

- Revenue sharing: none

- Airport-wide methodology: compensatory, according to the description in the 2022A OS page A-60.

- Airfield methodology: cost center residual, see page A-61

- Details: none, the rate package is not publicly available

- Terminal methodology: cost center compensatory, see page A-61

- Details: none

- True-up/settlement: settled in the following year through cash/credit, see page A-61

- Other comments:

- Traffic statistics: https://www.massport.com/logan-airport/about-logan/airport-statistics/

- The investor relationship site has the 1978 Trust Agreement and a Debt Policy.

BWI

Rate document:

- Name: Use and Lease Agreement

- Expiration date: June 30, 2026

- Link: appendix of the 2019 competition plan

- Investor relationship page: not found

Ratemaking:

- Residual protection: Extraordinary Coverage Protection (ECP), see section IX (D)

- Revenue sharing: none

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: total requirements divided by the total of signatory landed weight plus 125% of non-signatory landed weight (to reflect the 25% premium, which makes it a fully residual)

- Terminal methodology: cost center residual, but page 31 and the appendix consultant report of the 2021 OS call it commercial compensatory. This requires addition research – the OS does not include a calculation of terminal rental rates, and the ULA Exhibit 2 is not available

- Details: section VIII.A.1 provides that the ticket counter rental rate shall be adjusted Passenger Terminal Costs divided by the weighted square footage of the “Leasehold Areas excluding the Passenger Terminal Administration Space.,” while the Leasehold Areas is defined as “space leased” instead of rentable space

- True-up/settlement: reconciled in the following year through cash/credit, see section X.C

- Other comments:

- Traffic statistics: https://www.bwiairport.com/flying-with-us/about-bwi/statistics

- There is a Minimum Annual Guarantee for each signatory airline (including affiliates) at $200,000 annually, which is a threshold to become a signatory airline. Otherwise an airline would be subject to 25% non-signatory premium.

CLT

Rate document:

- Name: Airline Use and Lease Agreement

- Expiration date: June 30, 2026

- Link: https://downloads.ctfassets.net/jaw4bomip9l3/4COrUe7C3U6WW1XfzLTmTZ/e0d613d55d9b9b4eacec8595e35a01f2/Airline_Use_and_Lease_Agreement_July_1_2016-June_30_2026.pdf

- Investor relationship page: not found, but this is a nice page with financial information: https://www.cltairport.com/business/business-resources/

Ratemaking:

- Residual protection: ECP, see section 10.9

- Revenue sharing: 40% of Net Remaining Terminal Complex Revenues, see section 10.6

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: total requirements divided by total landed weight of air carriers. The cost recovery includes amortization of cash-funded assets and hard coverage, but the hard coverage will be returned at the year-end if not needed. See article 10.5.2.

- Terminal methodology: commercial compensatory

- Details: total requirements divided by Rentable Terminal Space, see section 8.03.B.4. However, Rentable Terminal Space includes nonairline rented space, but not vacant space by airlines or nonairlines

- True-up/settlement: reconciled in the following year through cash/credit, see section 10.5

- Other comments:

- Traffic statistics: https://cltairport.mediaroom.com/media#activity

DCA

Rate document:

- Name: Airport Use Agreement and Premises Lease

- Expiration date: December 31, 2024

- Link: https://www.mwaa.com/sites/mwaa.com/files/legacyfiles/use_and_lease_agreement_-_1.1.2015_0.pdf, with two amendments. The first amendment extends the IAD expiration from 2017 to 2024, among other revisions. The second amendment is primarily related to a Western Lands Account.

- Investor relationship page: https://www.mwaa.com/investor-relations#

Ratemaking:

- Residual protection: ECP in section 8.01, and also implied ECP in section 9.07.2

- Revenue sharing: 0% to 45% of Net Remaining Revenues with adjustments, see section 9.05

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center compensatory

- Details: total requirements less transfer (revenue sharing from the prior year) and divided by landed weight including general aviation. I assume that the general aviation is not subject to the calculated rates, so we will classify this as compensatory (not 100% cost recovery) instead of residual (100% recovery). See section 8.02.

- Terminal methodology: commercial compensatory

- Details: total requirements of each sub-cost center divided by total unweighted rentable space, with the resulting airline requirements net of transfer divided by weighted airline rented space. See section 8.03.

- True-up/settlement: reconciled in the following year through cash/credit, see section 9.07.1

- Other comments:

- Traffic statistics: https://www.mwaa.com/reagan-air-traffic-statistics

- The investor relationship site includes many useful documents, such as Master Trust Indenture or Investment Policy.

DEN

Rate document:

- Name: Airport Use and Lease Agreement

- Expiration date: Southwest and United in 2035, Frontier in 10 years after New Concourse A East, and all other airlines on December 31, 2023. The Frontier facility was approved in April 2022. There are multiple amendments for certain agreements, including at least 11 amendments for the agreement with United.

- Link: WestJet version https://denver.legistar.com/View.ashx?M=F&ID=6160997&GUID=AC01D1EA-E2D7-4918-9203-6C92AF18BE8D

- Investor relationship page: https://www.flydenver.com/about/financials/investor-information

Ratemaking:

- Residual protection: there does not appear to be an ECP clause. However, airlines acknowledge in section 6.01 that the Rate Maintenance Covenant must be met

- Revenue sharing: 50% of Remaining Net Revenues up to $40 million annually. The 2022AB OS page A-133 mentioned that the limit was increased to $50 million for FY 2022 through 2026.

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: total requirement divided by total landed weight

- Terminal methodology: cost center compensatory

- Details: total requirements divided by rentable space, with certain space at 65% weight

- True-up/settlement: reconciled in the following year through cash/credit, see section 6.05.

- Other comments:

- Traffic statistics: https://www.flydenver.com/about/financials/passenger_traffic

DFW

Rate document:

- Name: Lease and Use Agreement

- Expiration date: expired on September 30, 2021 and being extended month to month, according to page 15 of the 2022B OS.

- Link: https://downloads.ctfassets.net/m2p70vmwc019/1T0A6JrB6McaMNLbNrLUg/b030323834927149ed679c66c46dc2ea/DFW_Investors_Financials_Use_Agreement.pdf

- Investor relationship page: https://www.dfwairport.com/business/about/investors/

Ratemaking:

- Residual protection: yes, through the Lower Capital Thresholds that provide a minimum level of discretionary cash, and Incremental Coverage

- Revenue sharing: yes, through the Upper Capital Thresholds

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center compensatory

- Details: total requirement adjusted by Capital Threshold Adjustments and other adjustments/credits, and divided by landed weight of all Aircraft Operations. However, Exhibit F has a credit of “general aviation,” which, if stands for general aviation fuel flowage or landing fees, would make the ratemaking a cost center residual

- Terminal methodology: cost center residual

- Details: total requirements net of credits, requirements, and adjustments, and divided by airline leased space

- True-up/settlement: reconciled in the following year through mid-year rate adjustments, see section 5.4

- Other comments:

- Traffic statistics: https://www.dfwairport.com/business/about/stats/

- DFW has an ESG report on the investor relationship site. The site also has a lot of other useful information, such as Contract and Agreement, Master Bond Ordinance, Debt Policy, and rates and charges.

DTW

Rate document:

- Name: Airport Use and Lease Agreement

- Expiration date: September 30, 2032

- Link: https://www.metroairport.com/sites/default/files/business_documents/comp_plan/dtw_2008_competition_plan_update.pdf

- Investor relationship page: not found, but the authority keeps a page at https://www.metroairport.com/business/about-wcaa/facts-figures/financial-information

Ratemaking:

- Residual protection: through the landing fee calculation – see section III.F Activity Fees.

- Revenue sharing: none, but has $5 million annual discretionary cash, escalated by CPI

- Airport-wide methodology: residual

- Airfield methodology: airport residual

- Details: total Revenue Requirements divided by landed weight

- Terminal methodology: cost center residual

- Details: net requirements divided by airline leased space

- True-up/settlement: reconciled in the following year via cash/credit, see section III.I.5

- Other comments:

EWR

Not researched.

Traffic statistics: https://www.panynj.gov/airports/en/statistics-general-info.html

FLL

Rate document:

- Name: Airline-Airport Lease and Use Agreement

- Expiration date: extended through September 30, 2026, per page 34 of the 2019ABC OS

- Link: https://cragenda.broward.org/docs/2011/CCCM/20110927_262/9345_Lease%20and%20Use%20Agreement%20Jet%20Blue%20Executed%20Exh%202.pdf

- Investor relationship page: the county has a page at https://www.broward.org/Finance/pages/investorrelations.aspx

Ratemaking:

- Residual protection: yes, but implicit. FLL only has two final cost centers: Airfield and Terminal, and both are residual fully recovering costs, which makes FLL a residual airport.

- Revenue sharing: not applicable

- Airport-wide methodology: residual

- Airfield methodology: cost center residual

- Details: see Exhibit B section 6.a.

- Terminal methodology: cost center residual

- Details: net requirement divided by weighted rented space, see Exhibit B section 6.b

- True-up/settlement: reconciled in the following year through rate calculation, see Exhibit B-5

- Other comments:

- Traffic statistics:

- Nonsignatory premium is 30%

HNL

Rate document:

- Name: Airport-Airline Lease

- Expiration date: automatically renewed quarterly

- Link: see appendix A/B/C https://hidot.hawaii.gov/airports/files/2012/12/HNL-Competition-Plan-FY-2011-Final.pdf

- Investor relationship page: the state maintains a page at https://investorrelations.hawaii.gov/.

Ratemaking:

- Residual protection: Airports System Support Charges, see page 61 of Appendix A of the 2022AB OS

- Revenue sharing: none

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: net requirements divided by total landed weight

- Terminal methodology: cost center residual, except ITO

- Details: net requirements divided by rented terminal space

- True-up/settlement: reconciled in the same fiscal year through a separate Prepaid Airport Use Charge Fund, see page 62 of Appendix A of the 2022AB OS

- Other comments:

- Traffic statistics: https://hidot.hawaii.gov/airports/library/dota-statistics-page/. DBEDT provides many visitor statistics, including daily overseas visitor count.

- Certain interisland rates are multiplied by a discount ratio, which is increased by 1 percentage point annually

IAD

Same agreement as DCA. Traffic statistics is at: https://www.mwaa.com/dulles-air-traffic-statistics

IAH

Rate document:

- Name: varies. As described on page 51 the 2021 OS, The Houston Airport System has one lease agreement for each of the five terminals, plus additional non-terminal leases with United

- Expiration date:

- Terminal A: month to month

- Terminal B: 2041

- Terminal C: December 31, 2037

- Terminal D: December 31, 2021, and may be on a month-to-month as of now

- Terminal E: January 31, 2030

- Link:

- Investor relationship page: https://www.fly2houston.com/biz/about/investor-relations

Ratemaking:

- Residual protection: not found

- Revenue sharing: ratemaking for some terminals is on a net lease basis, where United keeps all concession revenues, see page A-112 of Appendix A of the 2018AB OS.

- Airport-wide methodology: hybrid compensatory

- Airfield methodology: cost center residual

- Details: see page A-114

- Terminal methodology: varies

- Details: see summary on page A-113

- True-up/settlement: unknown

- Other comments:

- Traffic statistics: https://www.fly2houston.com/newsroom/media-kit/traffic-and-statistics

JFK

Not researched.

Traffic statistics: https://www.panynj.gov/airports/en/statistics-general-info.html

LAS

Rate document:

- Name: Airline-Airport Use and Lease Agreement

- Expiration date: June 30, 2030, as discussed on page 47 of the 2021 OS

- Link: the original agreement can be found at https://www.sec.gov/Archives/edgar/data/1362468/000143774912001771/ex10-20.htm

- Investor relationship page: not found. Some financial information is at https://www.harryreidairport.com/Business/Finance/FinancialStatements

Ratemaking:

- Residual protection: ECP, see section 7.07

- Revenue sharing: embedded in ratesetting discussed below

- Airport-wide methodology: residual (edit: I changed this from hybrid residual to residual. Although LAS keeps a large amount of gaming revenues, CRCF revenues, amortization and other revenues, LAS prefers using residual)

- Airfield methodology: cost center residual

- Details: LAS has a complicated cost center structure, but in essence, is a dual cost center residual after reserving certain revenue streams. The reserved revenues include gaming revenues, net revenues from consolidated rental car facilities, amortization of cash-funded assets, and net of some costs of reliever airport costs. The landing fee calculation includes a credit from parking and roadway cost center, which includes rental car concession revenues.

- Terminal methodology: cost center residual

- Details: net requirements after nonairline revenue credit divided by airline rented space. See Appendix D1

- True-up/settlement: reconciled initially through Rate Stabilization Account and the Amortization Due from Signatory Airlines, and then via cash/credit. See section 7.06, but appendix D3 mentions that the landing fee calculation may include prior year true-up

- Other comments:

- Traffic statistics: https://www.harryreidairport.com/Business/Statistics

- LAS recovers amortization of cash-funded assets

- I am a good contributor to the gaming revenues, especially the Caesar machines.

LAX

Rate document:

- Name: Rates and Charges for the Use of the Terminal Facilities and Equipment (the 2021 Rate Methodology), and Further Amended and Restated Rate Agreement (the 2021 Rate Agreement)

- Expiration date: rate by resolution without ending date, but the rate agreement expires in 2032 (original) and 2033 (1st amendment)

- Link:

- Investor relationship page: https://www.lawa.org/lawa-investor-relations

Ratemaking:

- Residual protection: ECP (or ECPC) in the 2021 Rate Agreement. Although some airlines stay under the 2013 Rate Agreement, the ECP in the 2021 Rate Agreement is an effective residual safety net

- Revenue sharing: 50% of terminal concession revenues for domestic terminals or 25% of duty-free and currency exchange revenues for the FIS, see Article 4 of the 2021 Rate Agreement, plus 50% of the Net Terminal Area Cash flow exceeding the cap, see section 8.1

- Airport-wide methodology: hybrid residual (or, if this term is too hard to swallow, we can say “compensatory with ECP…”)

- Airfield methodology: cost center residual

- Details: total costs (including VNY reliever net costs) divided by total landed weight. See page A-32 of Appendix A of the 2022GHI OS

- Terminal methodology: compensatory

- Details: total costs (including hard coverage) divided by rentable space

- True-up/settlement: reconciled in the following year through cash/credit. See section 2.10 of the 2021 Rate Methodology

- Other comments:

- Traffic statistics: https://www.lawa.org/lawa-investor-relations/statistics-for-lax

- Rules and Reg page at: https://www.lawa.org/rules-and-regulations

- Rate base of course includes amortization of cash-funded assets

LGA

Not researched.

Traffic statistics: https://www.panynj.gov/airports/en/statistics-general-info.html

MCO

Rate document:

- Name:

- Second Amended and Restated Resolution of the Greater Orlando Aviation Authority (the 2019 Rate Resolution)

- Rate and Revenue Sharing Agreement (the 2019 Rate Agreement)

- Expiration date: none for 2019 Rate Resolution, and September 30, 2024 for the 2019 Rate Agreement

- Link:

- See appendix C of the 2022ABCDE OS for the 2019 Rate Resolution and the 2019 Rate Agreement

- 2019 Rate Methodology: https://orlandoairports.net/site/uploads/Rate-Book.pdf

- Investor relationship page: https://orlandoairports.net/airport-business/#investor-relations

Ratemaking:

- Residual protection: none

- Revenue sharing: the first $10M plus 50% of Remaining Revenues, see section 3.(b)(i) of the 2019 Rate Agreement

- Airport-wide methodology: hybrid compensatory

- Airfield methodology: cost center residual

- Details: total requirements (with amortization but not coverage) net of credits divided by total landed weight. See the 2019 Rate Methodology page 7

- Terminal methodology: commercial compensatory

- Details: total requirements (with amortization but not coverage) net of credits divided by rentable space

- True-up/settlement: reconciled in the following year through cash/credit, see section 7.1(c) of the 2019 Rate Resolution

- Other comments:

- Traffic statistics: https://orlandoairports.net/about-us/

- The 2019 Rate Methodology, which is the rate book for FY 2020, has a lot of useful details

MDW

Rate document:

- Name: Airport Use Agreement and Facility Lease

- Expiration date: December 31, 2027

- Link: https://www.cityofchicagoinvestors.com/midwayairportbonds/documents/view-file/i1414?mediaId=48827 (requires a free registration)

- Investor relationship page: https://www.cityofchicagoinvestors.com/midwayairportbonds/i1414

Ratemaking:

- Residual protection: yes, but implicit. MDW has 9 cost centers listed in section 8.01, with 1 indirect cost center allocated to other cost centers, and parking and roadway area and support facility area included in the calculation of landing fee. The other 6 cost centers are all fully residual, which results in a residual safety net

- Revenue sharing: none

- Airport-wide methodology: residual

- Airfield methodology: cost center residual

- Details: net requirements (including profit/loss from two other cost centers) divided by total landed weight, see section 8.03

- Terminal methodology: cost center residual

- Details: net requirements (net of nonairline revenues) divided by rented space, see section 8.04

- True-up/settlement: reconciled in the 2nd following year through cash/credit, see section 9.04

- Other comments:

- Traffic statistics: https://www.flychicago.com/business/CDA/factsfigures/Pages/airtraffic.aspx

- The most recent consultant report is in the 2016AB OS.

MIA

Rate document:

- Name: 2018 Airline Use Agreement

- Expiration date: April 30, 2033

- Link: https://www.miamidade.gov/govaction/legistarfiles/Matters/Y2018/181788.pdf

- Investor relationship page: not found. This page has the financial information: https://www.miami-airport.com/annual_report.asp

Ratemaking:

- Residual protection: yes, through landing fee calculation and also stated in section 9.G

- Revenue sharing: not applicable

- Airport-wide methodology: residual

- Airfield methodology: airport-wide residual

- Details: airport-wide net requirements (including reliever/general aviation airports) divided by landed weight, see Tab G

- Terminal methodology: compensatory

- Details: total costs divided by weighted rentable space, see Tab H1

- True-up/settlement: settled in the following year through rates and charges (transfer from the Improve Fund, net of certain discretionary cash), see Tab G

- Other comments:

- Traffic statistics: https://www.miami-airport.com/airport_stats.asp

- The annual rate book has a lot of useful details: https://www.miami-airport.com/library/pdfdoc/Rates_Fee_Charges_Book_FY_2022.pdf

MSP

Rate document:

- Name: Amended and Restated Airline Operating Agreement and Terminal Building Lease

- Expiration date: December 31, 2023 or December 31, 2030

- Link: see appendix D of the 2022AB OS

- Investor relationship page: https://metroairports.org/doing-business/investor-relations

Ratemaking:

- Residual protection: none

- Revenue sharing: 31% to 33% of net remaining revenues based on traffic growth

- Airport-wide methodology: hybrid compensatory (edit: I changed this from hybrid residual to hybrid compensatory. After re-read, I found the language in VI.C.1.f is not an ECP)

- Airfield methodology: cost center residual

- Details: net airfield costs divided by total landed weight, see section VI.C

- Terminal methodology: commercial compensatory

- Details: net terminal building costs divided by rentable space, see section VI.E for terminal 1. Terminal 2 rates are set by ordinance

- True-up/settlement: reconciled in the following year through cash/credit, see section VI.H

- Other comments:

- Traffic statistics: https://metroairports.org/msp-passenger-and-operations-reports

- MSP also has a separate lease agreement with Delta. See page 59 of the 2022AB OS

- The rate calculation does not cover the deposits to the Maintenance and Reserve Account, which is currently set by the Commission to equal six months of operating expenses and can be revised lower or higher

ORD

Rate document:

- Name: Airline Use and Lease Agreement

- Expiration date: December 31, 2023 or December 31, 2033

- Link: https://www.cityofchicagoinvestors.com/ohareairportbonds/documents/view-file/i1411?mediaId=229695

- Investor relationship page: https://www.cityofchicagoinvestors.com/ohareairportbonds/i1411

Ratemaking:

- Residual protection: yes, implicit through cost recovery of each cost center and also stated in sections 8.3.1.(l)

- Revenue sharing: not applicable

- Airport-wide methodology: residual

- Airfield methodology: cost center residual

- Details: net requirements divided by total landed weight, see section 8.2

- Terminal methodology: cost center residual

- Details: net requirements (including parking and ground transportation and other cost centers) divided by weighted terminal rented space

- True-up/settlement: terminal true-up amounts will be settled in the 2nd following year through cash/credit, and airfield true-up amounts will be setted in the 2nd following year through rate calculation. See section 8.17.

- Other comments:

- Traffic statistics: https://www.flychicago.com/business/CDA/factsfigures/Pages/airtraffic.aspx

- The discretionary cash is reserved under the Commercial Real Estate cost center, see section 8.13.

PDX

Rate document:

- Name: Amended and Restated signatory Passenger Airline Lease and Operating Agreement

- Expiration date: extended through June 30, 2030, see page 61 of the 28 OS.

- Link: https://airportscouncil.org/wp-content/uploads/2018/08/pdx_amended_and_restated_signatory_passenger_airline_lease_and_operating_agreement_alaska.pdf

- Investor relationship page: https://www.portofportland.com/FinanceAndStatistics

Ratemaking:

- Residual protection: yes, see section 18.1

- Revenue sharing: variable amounts based on debt service coverage and operating expenses, see articles 22 and 23

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: section 18.2 refers to airfield net requirements, which is not defined

- Terminal methodology: cost center residual

- Details: net requirements divided by weighted terminal rented space, see section 19.6.1

- True-up/settlement: reconciled in the following year through cash/credit, see section 20.3

- Other comments:

- Traffic statistics: https://www.portofportland.com/FinanceAndStatistics

PHL

Rate document:

- Name: Airport-airline Use and Lease Agreement

- Expiration date: June 30, 2022, as mentioned on page 28 of the 2021 OS

- Link: see attachment C: https://www.phl.org/drupalbin/media/PHL15comppplan.pdf

- Investor relationship page: https://www.phl.org/business/investor-information

Ratemaking:

- Residual protection: none. I couldn’t find a way to recover any potential loss from the Outside Terminal Area cost center, although that cost center is expected to generate more than $28 million of annual profit, as shown on table 1-5 of the 2021 OS

- Revenue sharing: if the Outside Terminal Area cost center net revenues in the prior fiscal year exceeds $7M, the signatory airlines will receive 50% of the amount above $7M. See section 5.06.C

- Airport-wide methodology: hybrid compensatory. However, several issues are worth mentioning:

- Page 28 of the 2021 OS claims that the airline rates and charges are established to meet the rate covenant requirements. This is true if the OTC always generates a profit

- The Rate Covenant is one of a kind

- The operating expenses are split between Net Operating Expenses and Interdepartmental Charges

- The Rate Covenant test allows unlimited fund balance: in FY 2021, the fund balance was $161M, while the annual debt service was $124M

- The first test of the Rate Covenant, a coverage test, only excludes to the Net Operating Expenses

- The second test, a flow test, still allows the inclusion of the fund balance

- Therefore, PHL has coverage ratios above 2x in 2019-2021. That being side, the airport-wide rate methodology is a hybrid compensatory - the airlines do not appear to have a contractual obligation to ensure the rate covenant compliance.

- Airfield methodology: cost center residual

- Details: net requirements (including reliver airport profit & loss) divided by signatory landed weight. See section 7.04

- Terminal methodology: cost center residual

- Details: net requirements (including settlement from the prior year) divided by weighted rented terminal space. See section 7.02

- True-up/settlement: reconciled in the following year through rate calculation, see section 7.06

- Other comments:

- Traffic statistics: https://www.phl.org/business/reports/activity-reports

PHX

Rate document:

- Name: rate by ordinance, see page 28 of the 2019ABC OS. I decided not to go looking for the 1981 resolution

- Expiration date: none

- Link: not available

- Investor relationship page: the City’s page is at https://www.phoenix.gov/finance/investor

Ratemaking:

- Residual protection: none

- Revenue sharing: none

- Airport-wide methodology: compensatory

- Airfield methodology: cost center compensatory

- Details: not public information available

- Terminal methodology: commercial compensatory

- Details: not public information available

- True-up/settlement: not public information available

- Other comments:

- Traffic statistics: https://www.skyharbor.com/About/Information/AirportStatistics

SAN

Rate document:

- Name: Airline Operating and Lease Agreement

- Expiration date: June 30, 2029

- Link: https://voiceofsandiego.org/wp-content/uploads/2020/04/SAN-Airline-Operating-and-Lease-Agreement-Execution-Copy-Alaska-Airlines10143.pdf

- Investor relationship page: not found. The financial information is mostly at https://www.san.org/Airport-Authority/Financials

Ratemaking:

- Residual protection: yes, Coverage Charges

- Revenue sharing: none

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: net requirements divided by signatory landed weight, see section 10.6

- Terminal methodology: commercial compensatory

- Details: base requirements divided by rentable space, plus supplement requirements divided by airline rented space. See section 10.8

- True-up/settlement: reconciled in the following year through cash/credit, see section 10.3

- Other comments:

- Traffic statistics: https://www.san.org/news/air-traffic-reports

- Section 10.3 has a minimum airline payment requirement, which is a threshold to become a signatory airline

- Section 10.10 has an exquisite design of joint use charges.

SEA

Rate document:

- Name: Signatory Lease and Operating Agreement

- Expiration date: December 31, 2022, in process of extension, see page 34 of the 2022ABC Sub OS

- Link: not found, but the final draft conditionally approved by the board is at: https://meetings.portseattle.org/portmeetings/attachments/2018/2018_02_27_SM_7a_attach.pdf

- Investor relationship page: https://www.portseattle.org/page/investor-relations

Ratemaking:

- Residual protection: none

- Revenue sharing: revenue sharing in 2018 and 2019, but none in 2020, 2021 or 2022

- Airport-wide methodology: compensatory

- Airfield methodology: cost center residual

- Details: net requirements divided by total landed weight, see section 8.2

- Terminal methodology: commercial compensatory

- Details: net requirements allocable to airline rented space as % of total rentable space, and then divided by weighted airline rented space

- True-up/settlement: reconciled in the following year through cash/credit, see section 8.18

- Other comments:

- Traffic statistics: https://www.portseattle.org/page/airport-statistics

SFO

Rate document:

- Name: Lease and Use Agreement

- Expiration date: extended through June 30, 2023, see page 59 of the 2022ABC OS

- Link: https://sfgov.legistar.com/View.ashx?M=F&ID=7779560&GUID=F7B28CED-36EF-42F7-971D-8AE205348B8A

- Investor relationship page: https://www.flysfo.com/about/finances/investor-relations

Ratemaking:

- Residual protection: yes, see section 505. The residual protection plus the settlement prior to audit create a bullet-proof residual protection, i.e., the settlement process after annual audit at some other residual airports may have a potential result of technical default.

- Revenue sharing: not applicable

- Airport-wide methodology: residual

- Airfield methodology: cost center residual

- Details: the net requirements also include any surplus from Groundside Area and net results of Airport Support Area, divided by total landed weight. See section 503

- Terminal methodology: compensatory/hybrid

- Details: basic rentals are calculated as requirement divided by gross building areas; rental surcharge is calculated as 50% of remaining terminal costs, plus net expenses of Groundside Area (but not net surplus), and divided by airline leased space. Both rate components are then adjusted for space weighting. See section 502.

- True-up/settlement: reconciled through the deferred aviation revenue and recognized in the same fiscal year, see section 505

- Other comments:

- Traffic statistics: https://www.flysfo.com/media/facts-statistics/air-traffic-statistics

- The investor relationship page has a lot of useful information

SLC

Rate document:

- Name: Airline Use Agreement

- Expiration date: June 30, 2024, except June 30, 2034 for Delta, as mentioned on page 51 of the 2021AB OS

- Link: see appendix D of the 2021AB OS. Oh, I love airports attaching AUA to OS. Sometimes it is really hard to find a public copy

- Investor relationship page: not found. The financial information is at https://slcairport.com/about-the-airport/financial-information/

Ratemaking:

- Residual protection: ECP, see section 8.11

- Revenue sharing: limited to the least of 30% of net remaining revenues, or selected concession revenues, or $1 per enplaned passenger, see section 8.07

- Airport-wide methodology: hybrid residual

- Airfield methodology: cost center residual

- Details: net requirements divided by total landed weight, see section 8.02

- Terminal methodology: commercial compensatory

- Details: net requirements multiplied by the ratio of airline rentable space to total rentable space, then adjusted for terminal space weight, see section 8.03

- True-up/settlement: reconciled in the following year through rate calculation, see section 8.06

- Other comments:

- Traffic statistics: https://slcairport.com/about-the-airport/airport-overview/air-traffic-statistics/

- The ESG report is at: https://slcairport.com/assets/pdfDocuments/Sustainability/SLC-ESG-Report-Final-6.3.21.pdf

TPA

Rate document:

- Name: Airline Rates, Fees and Charges Resolution

- Expiration date: not applicable

- Link: see appendix G of the 2022ABC OS

- Investor relationship page: https://www.tampaairport.com/investor-relations

Ratemaking:

- Residual protection: none. Section 10.7 ESC is a different charge

- Revenue sharing: 10% of net remaining revenues above $10M to space rental agreement signatories, see section 9.4.B

- Airport-wide methodology: hybrid compensatory

- Airfield methodology: cost center residual

- Details: net requirements divided by total landed weight, see section 9.1

- Terminal methodology: commercial compensatory

- Details: net requirements divided by rentable space

- True-up/settlement: reconciled in the following year through cash/credit. See section 9.4.A

- Other comments:

- Traffic statistics: https://www.tampaairport.com/facts-statistics-financials