Classifying Airline Rates and Charges Methodologies

(March 15, 2015 by Dafang Wu; PDF version)

This article clarifies the definitions of airline rates and charges methodologies and discusses considerations when selecting a rate methodology. Appendix A provides types of residual protection and revenue sharing at large-hub airports. This article should be read in conjunction with US Airports Rate Regulation. Rates and charges details for each large-hub airport can be accessed at this link.

Airline rates and charges methodologies, or airport/airline rate-setting methodologies, refer to how airports charge airlines for the use of airport facilities and equipment. U.S. airports typically set a landing fee for the use of an airfield, and a terminal rental rate for the use of terminal space. Implicitly, they decide how to recover the costs of landside operations, such as parking, rental car operations or ground transportation. Many airports also choose to set up rates for other facilities and equipment such as apron, common-use terminal space and equipment, loading bridges, and preconditioned air.

References to the rate methodologies are typically about the overall methodology for the airport, rather than the methodologies for the landing fee or terminal rental rate.

Classification of Rate Methodologies

The aviation industry classifies rate methodologies into 3 types: residual, compensatory, and hybrid. Those terms are created to satisfy the needs to quickly provide some information regarding an airport’s financial framework, similar to how cost per enplaned passenger (CPE) is used. Because there are no consistent definitions of the types of rate methodologies, an aviation professional should not rely on the classification of the rate methodologies published in the financial statements, reports, news articles, or even official statements and rating agency reports without examining the underlying details.

In Chapter 6 of Airport System Development published in 1984 by Princeton University, the author defined two types of rate methodologies:

- The residual-cost approach, under which the airlines collectively assume significant financial risk by agreeing to pay any costs of running the airport that are not allocated to other users or covered by nonairline sources of revenue,

- The compensatory approach, under which the airport operator assumes the major financial risk of running the airport and charges the airlines fees and rental rates so as to recover the actual costs of the facilities and services that they use

Note: Residual rate methodology cannot be imposed on the airlines without bilateral agreements.

With the developments in airport finance, the aviation industry created the third type, hybrid, without a consistent definition. In Chapter 18 of the FAA Airport Compliance Manual, the FAA defined hybrid as follows: “Sponsors frequently adopt rate-setting systems that employ elements of both residual and compensatory approaches. Such agreements may charge aeronautical users for the use of aeronautical facilities with aeronautical users assuming additional responsibility for airport costs in return for a sharing of nonaeronautical revenues that offset aeronautical costs.” In ACRP Report 36, Airport/Airline Agreements—Practices and Characteristics, the author defined hybrid as “any mixture or combination of the prior two approaches and may include a “revenue-sharing” component of excess non-airline revenues generated at the airport.”

Since then, any methodology that is not pure residual or pure compensatory is conveniently lumped into the hybrid category.

Why Do We Need Hybrid?

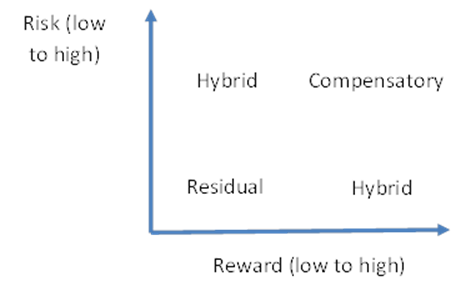

The creation of the hybrid terminology allows us to express a two-dimensional relationship between the airports and the airlines. In the 1984 Princeton book, the relationship is one-dimensional:

• Residual means a residual protection (thus little to no risk) to the airport, and little to no reward,

• Compensatory means no residual protection (thus high risk) to the airport, and high reward.

This relationship evolves into a two-dimensional framework to the airports:

Rate Methodologies - Current Classification

Redefining Classification

When a robot eventually replaces humans in determining the types of rate methodologies, it will be stuck here because the nebulous chart above has not clearly defined what is residual vs. compensatory, and it blends two very different types of contractual arrangements under the same term of hybrid.

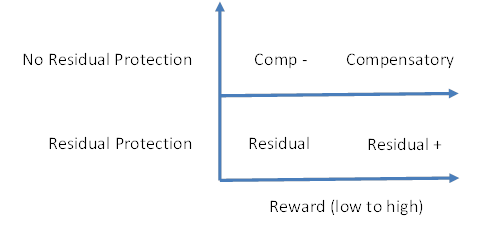

As aviation professionals, we are ultimately concerned about the risk, because the reward can take care of itself. Therefore, at the first step, we will revert to the 1984 Princeton approach and clearly separate all rate methodologies into two major categories. The determining factor is whether the airlines have collectively offered residual protection— paying whatever is necessary for the airports to meet all obligations.

Rate Methodologies – Interim Classification

In the second step, we will consider how to reflect the degree of reward in this framework.

- It is important to reflect the difference between residual and residual +, because residual + enjoys the benefit of a residual protection, and still owns an upside potential.

- It is not important to separate compensatory from compensatory -, because compensatory - does not gain any degree of a residual protection

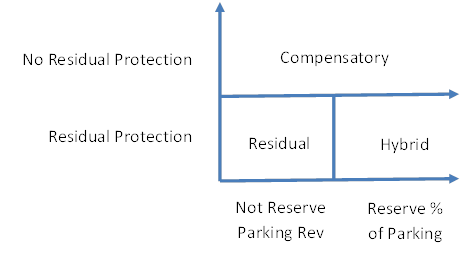

Therefore, we will eliminate compensatory -, and rename residual + as hybrid. Because parking revenues are typically the largest source of nonaeronautical revenues, I will propose modifying the Princeton definitions as follows:

- Residual: the airlines collectively assume significant financial risk by agreeing to pay any costs of running the airport that are not allocated to other users or covered by nonairline sources of revenue, and the airport reserves little to no discretionary cash flow.

- Hybrid: the airlines collectively assume significant financial risk by agreeing to pay any costs of running the airport that are not allocated to other users or covered by nonairline sources of revenue, and the airport reserves at least a portion of parking revenues, if not a portion of all revenues, as discretionary cash flow.

- Compensatory: the airport operator assumes the major financial risk of running the airport and charges the airlines fees and rental rates so as to recover the actual costs of the facilities and services that they use.

This set of definitions is illustrated as follows:

Rate Methodologies – Proposed Classification

Appendix A introduces typical types of residual protection and revenue sharing.

Selecting and Negotiating for a Rate Methodology

Selecting a rate methodology for an airport is very similar to conducting investment planning for an individual. Before starting the process, we need to understand the investment objectives/horizon, and to evaluate the risk tolerance.

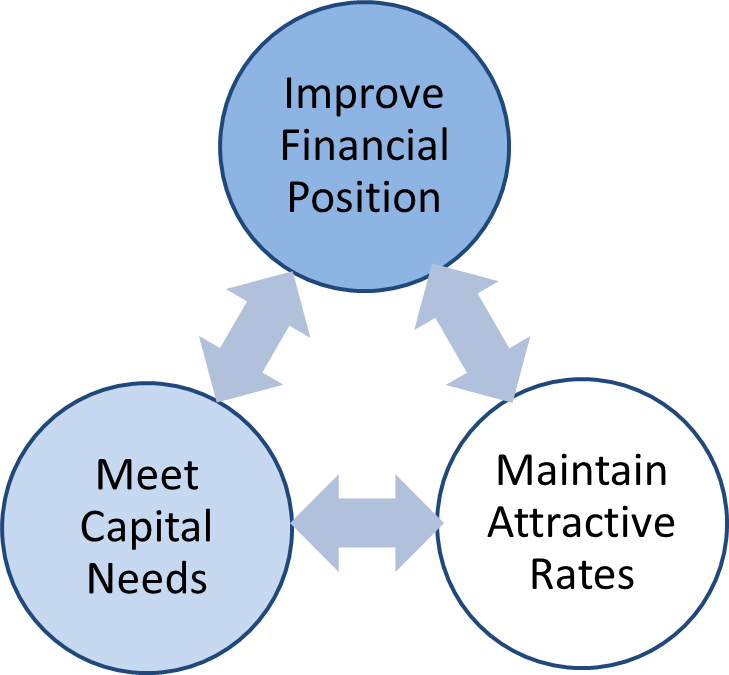

An airport’s objectives can be summarized in the following chart:

The three objectives conflict to a certain degree:

- Improving financial performance may require that the airport increase rates for the airlines.

- Investing in capital projects will negatively affect an airport’s finance performance, and usually lead to higher airline rates.

- Maintaining a low rate environment implies that the airport may not be able to generate higher cash flow to fund future capital projects.

Intuitively, selection of a rate methodology should be tied to an airport’s facility development lifecycle:

- Hybrid in Operation Stage. When an airport does not have major capital needs in the near or mid-term, the airport may attempt to balance the needs of improving its financial position and the needs of maintaining attractive airline rates. This can be achieved by implementing a hybrid rate methodology, where the airport shares net revenues to reduce airline costs, in exchange for a clause of extraordinary coverage protection. Although lower airport costs may not translate into lower ticket prices or higher air service levels, revenue sharing at least demonstrates the airports’ willingness to work with the airlines as business partners.

- Compensatory in Development Stage. When an airport anticipates a major capital need, the airport may select a compensatory rate methodology, if it is financially feasible. This preference is based on two considerations: (a) a compensatory rate methodology would typically yield higher discretionary cash flow for an airport, allowing an airport to build up cash reserves either for the capital project, or as a contingency fund for the post-DBO operations, and (b) the airport does not need airline approval to proceed with a capital project, if the airport implements rates unilaterally. Needless to say, building a major facility without airline support is not the best way to maintain a good relationship with the airlines.

- Residual in New Facility Stage. Immediately after the completion of a new facility, the airport’s financial situation may deteriorate due to the debt service payments and potentially higher operating expenses. Therefore, negotiating for a residual rate methodology would (a) provide the residual protection that an airport needs, and (b) reduce the airline costs to the lowest level possible, mitigating the rate impact due to the new facility.

The rate methodology an airport eventually reaches is influenced by far more factors than the airport’s preference. Among others:

- Residual rate methodology cannot be imposed on the airlines without bilateral agreements.

- An airport may not be able to afford to implement a compensatory rate methodology. Without an airline agreement, an airport must establish airline rates based on FAA guidelines. The airport may find out that the revenues under a potential compensatory rate methodology are not adequate to meet all financial obligations.

- As air carriers have reduced capacity at medium and small-hub airports, the negotiation power of those airports may have diminished.

In the end, there is no good or bad rate methodology. The airports and the airlines will continue working together to mitigate risks, develop revenues, and split the resulting risks and rewards, shaping the financial framework at each individual airport.

Appendix A

Residual Protection and Revenue Sharing

Types of Residual Protection

There are three typical types of residual protection: airport-wide residual landing fee, dual or multi-cost center residual rate-setting, and extraordinary coverage protection, each of which is described below.

Airport-Wide Residual Landing Fee

Under this type of rates methodology, an airport would calculate the landing fee rate to recover all airport capital costs and operating expenses, net of all revenues other than landing fee revenues. MIA has a long-term airline agreement expiring in 2017, and is known as an airport with pure residual rate methodologies. DTW is another large-hub airport with an airport-wide residual landing fee calculation.

Dual or Multi-Cost Center Residual

Under this type of rates methodology, an airport would establish two or more cost centers, and set up the rate in each cost center to fully recover the allocable costs.

- FLL and SFO are airports using dual cost center residual ratemaking. At these two airports, all airport capital costs and operating expenses are allocated either to the terminal cost center or to the airfield cost center, and then fully recovered through terminal rental rate and landing fee rate

- LAS has three residual cost centers: airfield, terminal and apron. ORD has six residual cost centers and MDW has five.

Residual rate methodology cannot be imposed on the airlines without bilateral agreements.

Extraordinary Coverage Protection (ECP)

Many airports share a certain amount of revenues with the airlines, and receive an ECP in return. The ECP allows the airports to recover from the airlines whatever amount is necessary to meet all of the airport’s financial obligations, which provides a safety net to the airports. Such large-hub airports include DCA/IAD, DEN, HNL, and TPA.

Types of Revenue Sharing at Airports with Hybrid Rate Methodologies

The airports with hybrid rate methodologies may share revenues in the form of net revenues remaining, which is the amount left after the airports meet all their financial obligations, or as a direct credit to the landing fee or the terminal rental rate calculation.

Metropolitan Washington Airport Authority has just executed new 10-year agreements with the airlines operating at DCA and IAD, effective January 1, 2015. In a draft airline agreement posted online, MWAA defines in Section 9.05 that Net Remaining Revenues shall equal Revenues plus Transfers less (i) O&M Expenses; (ii) required deposits to maintain the O&M Reserve; (iii) Debt Service; (iv) Federal Lease payment; (v) required deposits to any Debt Service Reserve Fund; and (vi) required deposits to the Emergency R&R Fund. MWAA further agreed that Net Remaining Revenues would be split between MWAA and the airlines, based on the formula described within Section 9.05. In return, MWAA receives an ECP. Both DEN and TPA use a similar rate methodology.

An airport may also apply a direct credit to the landing fee or the terminal rental rate calculation as a way of revenue sharing. At Hawaii Airports System, the Airports Division agreed to apply a credit of Airports System duty-free revenues to the calculation of HNL terminal rental rate. In return, the Airports Division can implement an Airports System Support Charge, if collected revenues are not adequate to fulfill all financial obligations.

Types of Revenue Sharing at Airports with Compensatory Rate Methodologies

As mentioned in other articles and videos, maximizing profits may not be the top priority of an airport’s financial operations. Under compensatory rate methodologies, many airports choose to share revenues with the airlines, in order to gain airline support of the capital program, rate calculation, or air service development. Those airports typically have a strong financial situation and enjoy high debt service coverage, and thus can afford to share certain revenues with the airlines. Because they don’t gain an ECP in return, the rate methodologies they are using are still classified as compensatory.

The approach through which those airports share revenues with the airlines is quite similar to their hybrid peer airports:

- Most airports, such as CLT, LAX, MCO, MSP, PDX, PHL, or SEA, share net remaining revenues or a portion of concession revenues.

- Other airports, such as ATL, may choose to credit some revenues to the calculation of terminal rental rate.

Some airports, such as BOS, DFW or PHX, have pure compensatory methodologies and do not share revenues with airlines.